Opportunity knocks.

Act 60 opens the door.

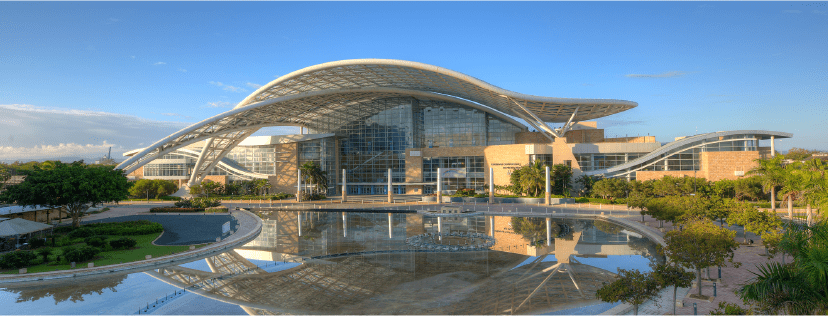

Hundreds of the world’s leading companies and visionary entrepreneurs already call Puerto Rico ‘home’. Here are a few reasons why you should as well.

As Puerto Rico writes a new chapter in its history, Invest Puerto Rico is fostering efforts to drive transformation. Chief among these is the newly created Puerto Rico Incentives Code (aka Act 60), an all-encompassing tool designed to accelerate economic growth through investment, innovation, export, and job creation.

Read on to learn what this means for you, or click here to download a high-level summary of Act 60. You can read the full English translation of Act 60 here, or click here to view the original Spanish version, also referred to as “Código de Incentivos de Puerto Rico,” Ley Núm. 60 de 1 de julio de 2019.

IN A NUTSHELL

Act 60 captures most of Puerto Rico’s tax incentive laws under one code, establishing an efficient process for granting and leveraging the benefits in your favor.

WHAT’S NEW

- The Office of Incentives for Businesses in Puerto Rico (OIBPR) is responsible for the administration of all incentive applications under Act 60.

- A Single Business Portal or “SBP,” was created for interested parties to apply for permits and incentives. Click here to visit the portal.

- The Island’s Qualified Opportunity Zones program is governed by the provisions of Act 60.

- New eligible activities under Act 60 include blockchain, recorded live events, and combined heat and power activities. (A full list of the new eligible activities will be made available in the near future on this page.)

- Act 60’s benefits are divided into “chapters,” each one addressing specific sectors: Individuals, Export (Services and Goods), Financial and Insurance Services, Visitor Economy, Manufacturing (including R&D), Infrastructure, Farming, Creative Industries, Entrepreneurship, Air and Sea Transport, and others.

- Tax exemption decrees now have a standardized 15-year term, and are subject to renegotiation for an additional fifteen years.

- Additional benefits for small- and medium-sized businesses were established for the Puerto Rican islands of Vieques and Culebra.

WHAT’S IN IT FOR YOU?

Some of Act 60’s highlights:

- 4% flat income tax rate

- 0% Distribution of Dividends Rate

- 75% Property Tax Exemption

- 75% Exemption on Construction Taxes

- 50% Exemption on other Municipal Taxes

- 50% Municipal Patent Exemption*